How long will the crisis in the oil industry last?

Industry Crisis

Oil industry faces biggest crisis in 100 years. David Sheppard, Financial Times says “Producers are facing up to the crash in oil demand as coronavirus forces economies into hibernation”. Because of the spread of COVID-19 the oil industry is facing up to the fact that fuel demand is going to fall faster than ever before.

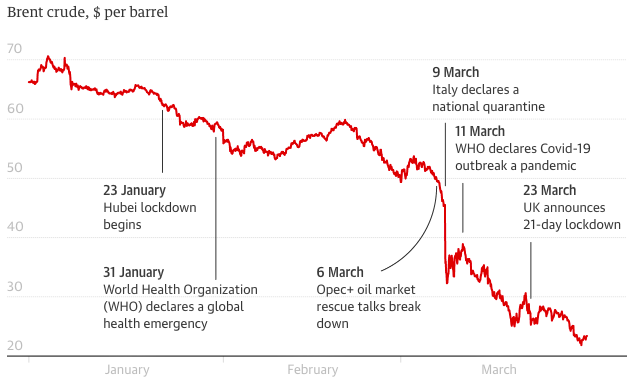

Here is a graph that shows how coronavirus and a price war has sent oil tumbling.

Oil industry experts give different opinions in this regard. One of them states that lower oil prices are always a good thing in the global perspective regardless.

If oil prices went to zero it would be fabulous for the global economy. Oil prices function as an energy tax on all finished goods and services throughout economy to a varying degree. Oil is a commodity not a finished good or service. Digging stuff out of the ground is not economically compelling.

Falling global oil prices will likely preclude a global recession for the next few years. Therefore this is functionally a massive economic boost.

Yes falling global oil prices have delivered a big boost to the global economy as everyone benefits from lower oil / energy prices including oil producers (in the long term). Energy prices act a global economic tax, falling oil prices are great for the USA and global economies as they function as a massive pervasive persistent global tax cut.

Future Projections

Now for the impact and the future projections. What is happening is the rise of USA shale oil fracking has permanently changed the global oil production market. This means a permanent long lasting economic transfer of wealth from oil producing nations to oil consuming nations. In the end cheaper oil prices will bring more stability to all nations as oil production is not an economic value add. Produced oil is a raw material far less valuable than finished economic goods and services.

One final note is that cheaper oil prices may likely stabilize the Middle East as oil revenue is the lifeblood of war and conflict in the Middle East.

These US shale oil wells are cheap, predictable and can be turned off and on like a light switch. When oil prices rise the oil wells turn on, the future production is sold on the futures market and rock solid no risk profit is locked in. Oil price volatility in the upward direction will likely be a distant past memory forever.

USA shale oil production is highly flexible and scalable as it can be ramped up and ramped down within weeks to match increasing and falling oil demand at minimal economic cost. When oil supply can closely tracks oil demand, oil price stability ensues with minimal oil production booms and busts.

Experts can’t really tell the date where crisis will be over. They think it will happen when one of the two main forces in oil industry is fixed the price of oil will recover to the level of $60 per barrel or so. When both are fixed the price will go back to the $100 per barrel area. Those are both enough above the current price below $30 to make a big difference to the economies of oil producers and the world.